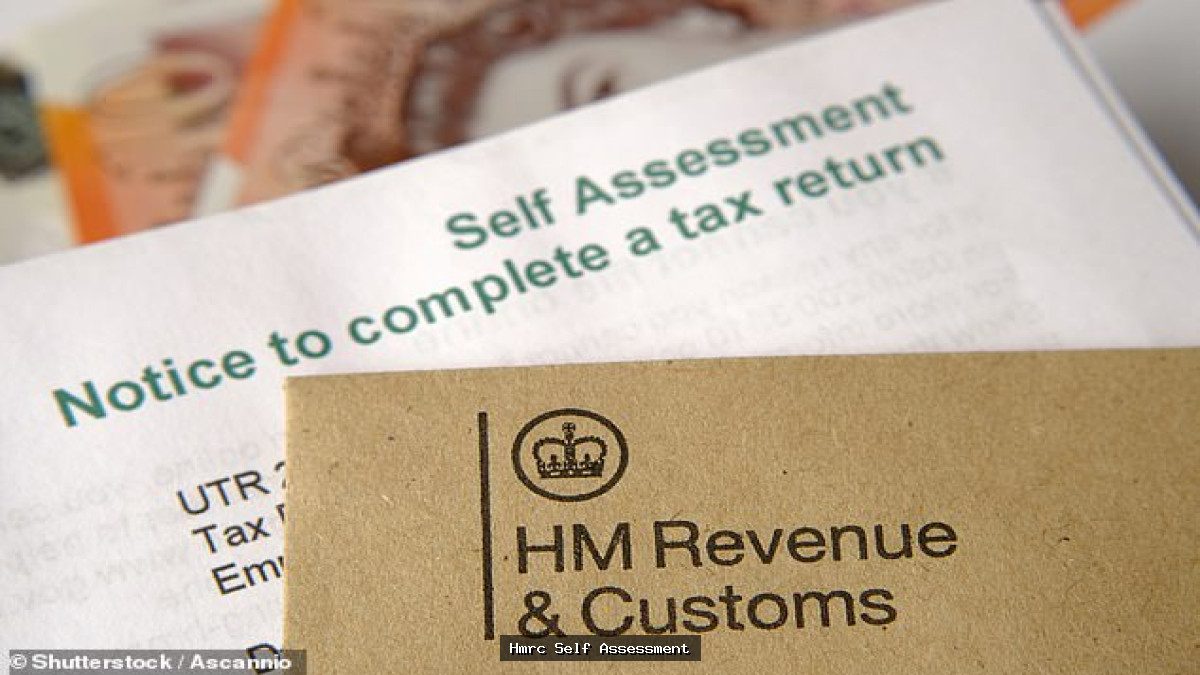

HMRC Self Assessment: Your 2025 Step-by-Step Guide

- Update Time : 03:04:05 pm, Monday, 28 July 2025

- / 4

Finding way the world of taxes can feel like crossing over a complicated maze, especially when it comes to HMRC self assessment. For many self-used individuals, landlords, and those with complicated financial situations, the yearly self assessment tax return is a necessary, but often frightening, task. Understanding the ins and outs of this process is very important for making sure compliance, avoiding penalties, and potentially even identifying opportunities for tax savings.

In this complete guide, we will demystify HMRC self assessment, walking you through everything you need to know to confidently manage your tax obligations. We’ll cover the fundamentals of self assessment, including who needs to file, what income needs to be told about, and the key deadlines to remember. We’ll also travel to find the various tools and resources available to help you complete your return accurately and efficiently, from online filing to allowable expenses and tax relief options. Furthermore, we’ll delve into common pitfalls and mistakes to avoid, making sure you stay on the right side of HMRC and optimize your tax position.

Understanding HMRC self assessment is more important than ever in today’s rapidly evolving money related landscape. Whether you’re a seasoned entrepreneur or just starting out, mastering the self assessment process gives power to you to take power over of your finances, meet your legal obligations, and ultimately, give to to a more safe financial future. By the end of this guide, you’ll have the what you know and confidence to tackle your self assessment tax return with ease, freeing up your time and energy to focus on what matters most: growing your business and reaching goal your financial goals.

What is hmrc self assessment and Why It Matters

HMRC self assessment is the system used by HM Revenue & Customs (HMRC) to gather Income Tax and National Insurance from individuals who put on clothes’t have these deductions made automatically through PAYE (Pay As You Earn). It’s a way for certain individuals to state officially their income and figure out the tax they owe. The HMRC provides small part guidance on the self assessment process and its requirements.

Who Needs to File a Self Assessment Tax Return?

Not everyone needs to complete a self assessment. Generally, you’ll need to file a return if you are self-used, a partner in a partnership, a company director, or if you receive income that hasn’t been taxed through PAYE. Examples include:

- Self-used individuals earning over £1,000.

- Landlords receiving rental income.

- Individuals with income from savings, investments, or dividends going over certain thresholds.

- Those receiving taxable from another country income.

- Individuals claiming certain expenses or reliefs not automatically applied through PAYE.

Even if your income is below certain thresholds, you might still need to file if HMRC teaches you to do so. For a complete overview, consult our HMRC self assessment setup checklist.

The Core Components of Self Assessment

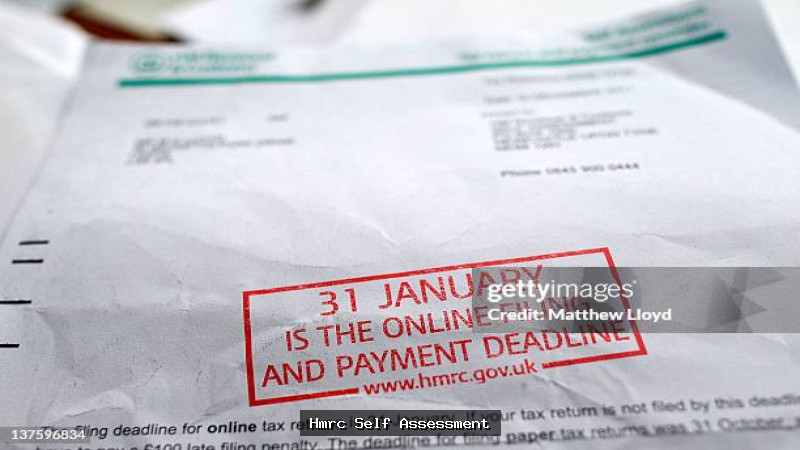

The self assessment process includes several key steps. First, you need to register for self assessment if you haven’t already done so. Next, you’ll gather all the necessary information about your income and expenses for the tax year (April 6th to April 5th). You then complete your self assessment tax return, either online or on paper. Finally, you figure out the tax you owe and pay it by the important to topic deadline. The online filing deadline is typically January 31st following the end of the tax year. For example, for the tax year 2023-2024, the online filing deadline is January 31st, 2025.

Why Self Assessment Matters

Right self assessment is very important for several reasons. Firstly, it makes sure you obey with UK tax law and avoid penalties for late filing or incorrect returns. Penalties can area from fixed fines to percentage-based charges on unpaid tax. Secondly, it allows you to claim all was suitable expenses and reliefs, potentially making less your tax bill.

For instance, self-used individuals can take away allowable business expenses such as office costs, travel expenses, and equipment buys. Finally, understanding self assessment gives power to you to manage your finances effectively and make informed decisions about your business or personal finances. Tools like the competency framework self assessment tool spoke about in source 2 can even help you scheme your personal or skilled development. For those just starting out, our hmrc self assessment for beginners guide can be very helpful.

Complete Guide to Understanding hmrc self assessment

Finding way the UK tax system as a self-used single person or someone with complicated income can be difficult tasking. HMRC self assessment is the method by which individuals tell about their income and figure out their tax responsibility directly to HM Revenue & Customs. This section provides a complete guide to understanding the self assessment process, helping you find way the requirements, deadlines, and available resources. According to Wikipedia’s overview of taxation in the United Kingdom, the UK tax system has a long history of self assessment.

Who Needs to File a Self Assessment Tax Return?

Not everyone needs to complete a self assessment tax return. Typically, you’ll need to file one if you’re self-used, a partner in a partnership, or if you receive income that isn’t taxed at source. This includes income from paying to use out property, receiving dividends from shares, or earning more than £1,000 from self-employment. For example, if you are a freelance web developer earning £20,000 a year, you are required to complete a self assessment tax return.

- Self-used individuals

- Landlords

- Individuals with high income

- Those receiving untaxed income

Key Deadlines and Filing Online

Missing the deadlines for self assessment can result in penalties, so it’s very important to be aware of the key dates. The deadline for online filing is typically January 31st following the end of the tax year (April 5th). If you like better to file a paper return, the deadline is earlier, usually October 31st. Filing online gives several advantages, including immediate confirmation of receipt and access to helpful tools and resources.

The GOV.UK website provides a doorway to file your self assessment return online and manage your tax affairs. Remember to register for HMRC online services well in move forward of the deadline. The BBC’s guide to self-assessment provides helpful tips and reminders for meeting deadlines. For troubleshooting common issues, check out our hmrc self assessment troubleshooting guide.

Allowable Expenses and Tax Relief

One of the benefits of self assessment is the ability to take away allowable business expenses from your taxable income, potentially making less your tax bill. These expenses can include office costs, travel expenses, and the cost of goods sold. For instance, a clear picture designer working from home can claim a part of their usefulness bills as a business expense. It’s important to keep right records of all your income and expenses to support your claims.

HMRC provides guidance on what expenses are allowable. Claiming tax relief for pension contributions or giving to others donations can also further make less your tax responsibility. Forbes discusses strategies for making biggest tax deductions which is important to topic to self assessment. To learn more about moved forward techniques, see our small part setup guide.

Best Practices and Strategies for hmrc self assessment

Finding way HMRC self assessment efficiently and effectively requires a schemed come near. It’s not just about completing your legal obligations; it’s also about optimizing your tax position and making smaller stress. By taking as your own best practices, you can streamline the process, make less the risk of errors, and potentially uncover opportunities for tax savings.

Very careful Record Keeping

Right and organized record keeping is the cornerstone of successful self assessment. Keep small part records of all income and expenses throughout the tax year. This includes invoices, receipts, bank statements, and any other documentation that supports your financial transactions. For example, if you’re claiming expenses for working from home, keep up records of usefulness bills and the percentage of your home used for business. Using accounting software or spreadsheets can significantly simplify this process. Regularly backing up your records is also very important to prevent data loss.

- Put in groups expenses accurately for easy telling about.

- Keep digital copies of all important to topic official papers for easy access.

- Make up after fight your records regularly to identify any discrepancies.

Using Available Resources and Tools

HMRC provides a wealth of online resources and tools to help with self assessment. The GOV.UK website (as seen in the provided sources) gives complete guidance on various aspects of self assessment, including eligibility, telling about requirements, and allowable expenses. The Civil Service Learning doorway, spoke about in one of the sources, can also give development schemes.

Familiarize yourself with these resources to make sure you’re claiming all was suitable deductions and benefits. Think about using HMRC-approved accounting software, which can automate many aspects of the process and make less the risk of errors. Our tools and resources page gives additional help with hmrc self assessment…

Scheming and Timely Submission

Procrastination can lead to errors and missed deadlines, resulting in penalties. Start getting prepared your self assessment well in move forward of the filing deadline (usually January 31st for online submissions). This gives you plenty of time to gather all necessary information, review your return thoroughly, and seek skilled advice if needed. Paying your tax bill on time is equally important.

HMRC gives various payment options, including online banking, straight debit, and payment by post. Make sure you understand the payment deadlines and choose a method that suits your needs. Regularly reviewing your tax position throughout the year can help you think will happen your tax responsibility and scheme accordingly. For more small part information about scheming, check out our complete guide to precise topic.

Common Difficult tasks and Solutions with hmrc self assessment

Finding way HMRC self assessment can present various difficult tasks for taxpayers. From understanding complicated regulations to managing deadlines and accurately telling about income, many find the process flooding with feeling. However, with awareness and proactive scheming, these difficult tasks can be effectively spoke to, making sure compliance and making smaller possible errors. The Start (a rule) of Chartered Accountants in England and Wales (ICAEW) gives resources and support for understanding complicated tax regulations.

Difficulty Understanding Eligibility and Registration

One common obstacle is determining whether you need to file a self assessment tax return in the first place and then registering correctly. If you’re self-used, a partner in a partnership, receive income from paying to use out a property, or have untaxed income going over £2,500, you likely need to register. Many individuals mistakenly believe that if they are used, they put on clothes’t need to file, missing or not paying attention additional income sources.

Solution: Use the GOV.UK website to check your precise circumstances. For example, if you start a side hurry and earn over £1,000, you’re legally required to tell about that income. Registering for self assessment includes getting a Unique Taxpayer Reference (UTR) – keep this safe as it’s very important for all future filings.

- Check GOV.UK for eligibility criteria.

- Register well in move forward of the filing deadline.

- Keep your UTR in a safe location.

Right Record Keeping and Expense Claims

Keeping up right records of income and expenses is very important for a smooth self assessment. Many taxpayers struggle with this, leading to errors or missed opportunities for claiming allowable expenses. For instance, self-used individuals can take away expenses like office supplies, business travel, and skilled subscriptions. Solution: Implement a system for tracking income and expenses throughout the year. Cloud-based accounting software or even a simple spreadsheet can be very worth a lot. Keep all receipts and invoices organized. HMRC also provides guidance on allowable expenses for different types of income.

Meeting Deadlines and Avoiding Penalties

Missing the self assessment filing deadline (31st January for online returns) results in automatic penalties. Many people procrastinate, leaving not enough time to gather the necessary information and complete the return accurately. Solution: Set reminders well in move forward of the deadline. Gather all required official papers early.

Think about filing your return well before the deadline to avoid last-tiny stress and possible system overload on the HMRC website. If you think will happen difficulty paying your tax bill, contact HMRC as soon as possible to discuss payment options. Attractive a punishment (SA370 Appeal) is possible if you have a reasonable excuse, such as a serious illness or bereavement. To learn more about best practices, review our Best practices for hmrc self assessment guide.

Moved forward Tips and Future Trends for hmrc self assessment

Finding way HMRC self assessment effectively goes beyond simply filing your tax return on time. It includes schemed scheming, leveraging available tools, and staying informed about upcoming changes. This section delves into moved forward tips and travels to discover future trends to help you optimize your self assessment process and potentially make less your tax liabilities.

Optimizing Expense Claims and Deductions

Making biggest allowable expenses is very important for making less your tax bill. Go beyond the usual claims and travel to find less common deductions important to topic to your precise circumstances. For example, if you use a part of your home exclusively for business, you can claim a part of a whole of your usefulness bills and loan for house interest. Remember to keep very careful records of all expenses, including receipts and invoices, to support your claims in situation of an HMRC inquiry. Utilise software or apps designed for expense tracking to simplify this process and make sure accuracy.

- Research industry-precise allowances: Certain professions have unique deductible expenses.

- Understand the “wholly and exclusively” rule: Expenses must be solely for business purposes.

- Claim capital allowances for important buys: Depreciate assets like equipment over their useful life.

Leveraging Digital Tools and Automation

The future of self assessment is undoubtedly digital. Hug online accounting software and HMRC’s online services to streamline your tax return process. Many platforms give features like automated bank feeds, invoice generation, and real-time profit and loss tracking.

Travel to find HMRC’s API developer hub to understand how software puts together directly with their systems, potentially simplifying data submission. Think about using bridging software if you are using older accounting methods to make sure MTD (Making Tax Digital) compliance. MIT’s Sloan School of Management publishes research on the impact of digital transformation on accounting and tax practices. You can find practical examples in our situation studies collection showing…

Getting prepared for Making Tax Digital (MTD) Expansion

Making Tax Digital is changing form the way businesses tell about income to HMRC. While currently mandated for VAT-registered businesses, MTD for Income Tax Self Assessment (ITSA) is being turned over out to other taxpayers. Stay informed about the setup timeline and requirements for your precise business type. Make sure your accounting software is MTD-can work together and familiarize yourself with the digital record-keeping obligations. Proactive preparation will make sure a smooth change from one to another and avoid possible penalties. The new rules are likely to require quarterly updates, so get prepared to change your processes.

Complete hmrc self assessment Data and Comparisons

Comparison Table: Different hmrc self assessment Options

Here’s a small part comparison of various hmrc self assessment comes near, including DIY, using accounting software, and hiring a skilled accountant.

| Feature | DIY (Online Form) | Accounting Software | Skilled Accountant | Best For |

|---|---|---|---|---|

| Cost | Lowest (Free) | Moderate (Subscription) | Highest (Hourly/Fixed Fee) | Simple tax situations |

| Time Promise | High | Moderate | Low | Those short on time |

| Accuracy | Dependent on user what you know | Higher (Automated calculations) | Highest (Very skilled person what you know) | Complicated tax situations |

| Support | Limited (HMRC website) | Moderate (Software support) | Very wide (Personalized advice) | Those needing guidance |

Statistics and Key Data for hmrc self assessment

Important statistics about hmrc self assessment, highlighting filing methods and punishment rates.

| Metric | Value | Source | Year |

|---|---|---|---|

| Percentage of Self Assessment Returns Filed Online | Over 90% | HMRC Formal Statistics | 2023-2024 |

| Average Punishment for Late Filing | £100 (First Fixed Punishment) | HMRC Penalties Information | 2024 |

| Number of Self-Used Individuals in the UK | Approximately 4.3 million | Office for National Statistics (ONS) | 2023 |

Pros and Cons of hmrc self assessment

A balanced view of the advantages and disadvantages of managing your HMRC self assessment, along with mitigation strategies.

| Advantages | Disadvantages | Mitigation |

|---|---|---|

| Power over over Finances | Time-Eating or using up | Set aside for devoted to time slots |

| Possible Tax Savings (Claiming allowable expenses) | Risk of Errors | Use accounting software or seek skilled advice |

| Straight Understanding of Tax Position | Complexity of Regulations | Consult HMRC guidance or a tax advisor |

For a deeper dive into self assessment, see our Moved forward hmrc self assessment strategies.

Frequently Asked Questions About hmrc self assessment

What is hmrc self assessment?

HMRC self assessment is the system used by HM Revenue & Customs for individuals to state officially their income and figure out their tax responsibility when tax isn’t automatically took away through PAYE (Pay As You Earn). It’s a way for self-used individuals, landlords, partners in partnerships, and those with other untaxed income to tell about their earnings and pay the suitable Income Tax and National Insurance. Right self assessment is very important for obeying with UK tax law, avoiding penalties, and claiming was suitable expenses and reliefs to potentially make less your tax bill. CNN provides updates on tax regulations and changes which can impact self assessment.

How do I get started with hmrc self assessment?

If you need to file a self assessment tax return, your first step is to register on the GOV.UK website to receive a Unique Taxpayer Reference (UTR). Gather all important to topic income and expense records for the tax year (April 6th to April 5th). Then, complete your self assessment tax return online through the HMRC doorway, making sure you accurately tell about all income and claim allowable expenses. Finally, figure out the tax you owe and pay it by the January 31st online filing deadline to avoid penalties.

What are the main benefits of hmrc self assessment?

The main benefit of HMRC self assessment is compliance with UK tax laws, helping you avoid penalties for late filing or incorrect returns. It also allows you to claim all was suitable business expenses and tax reliefs, potentially making less your overall tax responsibility. Furthermore, understanding the self assessment process gives power to you to manage your finances effectively, make informed business decisions, and give to to a more safe financial future.

What are common difficult tasks with hmrc self assessment?

Common difficult tasks include understanding eligibility requirements, accurately recording income and expenses, and meeting deadlines. Many find it difficult to determine if they need to file, especially with multiple income sources. Keeping up organized records of all financial transactions throughout the year is very important but often not succeeded to care for, leading to missed expense claims. Procrastination and not succeeding to file by the January 31st deadline are often causes of penalties.

How much does hmrc self assessment cost?

Filing a self assessment tax return itself doesn’t have a straight cost, but not succeeding to file on time or accurately can result in penalties, which can area from fixed fines to percentage-based charges on unpaid tax. The cost of accounting software or skilled tax advice can vary depending on the complexity of your tax situation and the services you require. Budgeting for these possible costs and putting first right record-keeping can help make smaller your overall expenses told a story to self assessment.

What tools or resources do I need for hmrc self assessment?

Very important tools and resources include a Unique Taxpayer Reference (UTR), right records of all income and expenses, and access to the internet for online filing. You’ll also need accounting software or spreadsheets to track your finances. The GOV.UK website provides complete guidance and resources on self assessment. Think about using HMRC-approved accounting software to automate many aspects of the process and make less the risk of errors.

How long does it take to see results with hmrc self assessment?

The “results” of self assessment are primarily told a story to compliance and managing your tax responsibility. You’ll see immediate results in terms of completing your legal obligations upon successful filing. The financial benefits, such as made less tax responsibility from claiming expenses, are understood when your tax return is processed and your tax bill is figured out. Building a firm understanding of the process and implementing doing well with little waste record-keeping systems takes time and always same effort.

What are the best practices for hmrc self assessment?

Best practices include very careful record-keeping of all income and expenses throughout the tax year, using available resources and tools provided by HMRC, and scheming well in move forward of the filing deadline. Keep digital copies of all important to topic official papers for easy access and regularly make up after fight your records to identify any discrepancies. Seek skilled tax advice if needed, especially if you have complicated financial situations or are unsure about precise deductions or reliefs. For more information, consult our hmrc self assessment tools and resources.

Frequently Asked Questions

Find answers to the most common questions below

Who Needs to File a Self Assessment Tax Return?

Not everyone needs to complete a self assessment. Generally, you'll need to file a return if you are self-employed, a partner in a partnership, a company director, or if you receive income that hasn't been taxed through PAYE. Examples include:

How do I get started with hmrc self assessment?

If you need to file a self assessment tax return, your first step is to register on the GOV.UK website to receive a Unique Taxpayer Reference (UTR). Gather all relevant income and expense records for the tax year (April 6th to April 5th). Then, complete your self assessment tax return online through the HMRC portal, ensuring you accurately report all income and claim allowable expenses. Finally, calculate the tax you owe and pay it by the January 31st online filing deadline to avoid penalties.

What are the main benefits of hmrc self assessment?

The primary benefit of HMRC self assessment is compliance with UK tax laws, helping you avoid penalties for late filing or incorrect returns. It also allows you to claim all eligible business expenses and tax reliefs, potentially reducing your overall tax liability. Furthermore, understanding the self assessment process empowers you to manage your finances effectively, make informed business decisions, and contribute to a more secure financial future.

What are common challenges with hmrc self assessment?

Common challenges include understanding eligibility requirements, accurately recording income and expenses, and meeting deadlines. Many find it difficult to determine if they need to file, especially with multiple income sources. Maintaining organized records of all financial transactions throughout the year is crucial but often neglected, leading to missed expense claims. Procrastination and failing to file by the January 31st deadline are frequent causes of penalties.

How much does hmrc self assessment cost?

Filing a self assessment tax return itself doesn't have a direct cost, but failing to file on time or accurately can result in penalties, which can range from fixed fines to percentage-based charges on unpaid tax. The cost of accounting software or professional tax advice can vary depending on the complexity of your tax situation and the services you require. Budgeting for these potential costs and prioritizing accurate record-keeping can help minimize your overall expenses related to self assessment.

What tools or resources do I need for hmrc self assessment?

Essential tools and resources include a Unique Taxpayer Reference (UTR), accurate records of all income and expenses, and access to the internet for online filing. You'll also need accounting software or spreadsheets to track your finances. The GOV.UK website provides comprehensive guidance and resources on self assessment. Consider using HMRC-approved accounting software to automate many aspects of the process and reduce the risk of errors.

How long does it take to see results with hmrc self assessment?

The \"results\" of self assessment are primarily related to compliance and managing your tax liability. You'll see immediate results in terms of fulfilling your legal obligations upon successful filing. The financial benefits, such as reduced tax liability from claiming expenses, are realized when your tax return is processed and your tax bill is calculated. Building a solid understanding of the process and implementing efficient record-keeping systems takes time and consistent effort.

What are the best practices for hmrc self assessment?

Best practices include meticulous record-keeping of all income and expenses throughout the tax year, utilizing available resources and tools provided by HMRC, and planning well in advance of the filing deadline. Keep digital copies of all relevant documents for easy access and regularly reconcile your records to identify any discrepancies. Seek professional tax advice if needed, especially if you have complex financial situations or are unsure about specific deductions or reliefs. For more information, consult our hmrc self assessment tools and resources.