Cost of Living Payments: 5 Ways To Get Help

- Update Time : 05:03:04 pm, Tuesday, 29 July 2025

- / 4

Professional cost living payments: guide image. cost of living payments - Optimized for search engines and user engagement.

In times of economic uncertainty, the phrase “cost of living” looms large in everyday conversations. Rising prices for essential goods and services can strain household budgets, leaving many struggling to make ends meet. Fortunately, governments and organizations often step in with various forms of assistance, most notably, cost of living payments, designed to alleviate some of this financial pressure. For a comprehensive overview, refer to Wikipedia’s definition of Cost of Living.

This comprehensive guide will delve into the world of cost of living payments, exploring their purpose, types, and eligibility criteria. We’ll examine how these payments are calculated, often tied to indices like the Consumer Price Index (CPI), and how they impact different segments of the population, including Social Security recipients, pensioners, and low-income families.

We’ll also explore specific examples of cost of living support programs, such as the UK’s Cost of Living Payments distributed by the DWP, and the Cost-of-Living Adjustments (COLA) provided by the Social Security Administration in the United States. You can find more details on these adjustments on the Social Security Administration’s website. Furthermore, we will provide guidance on how to identify potential scams and protect your personal information when seeking out cost of living assistance.

Understanding cost of living payments is more critical now than ever. With inflation rates fluctuating and economic landscapes constantly shifting, knowing your eligibility for these programs can provide a crucial safety net. By staying informed, you can ensure you receive the support you’re entitled to, navigate potential financial challenges, and maintain a degree of financial stability during uncertain times. This knowledge empowers you to advocate for yourself and your family, making informed decisions that contribute to your overall well-being and peace of mind. For those just getting started, our step-by-step tutorial provides a great foundation.

What is cost of living payments and Why It Matters

Cost of living payments are financial aids designed to help individuals and families cope with rising expenses related to basic necessities. These payments aim to alleviate the burden of inflation and economic pressures, ensuring that people can afford essential goods and services such as food, housing, and energy. Understanding these payments, who is eligible, and how they are calculated is crucial for financial stability and planning.

Understanding Cost-of-Living Adjustments (COLA)

A Cost-of-Living Adjustment (COLA) is an increase in compensation, benefits, or payments intended to counteract the effects of inflation. For example, the Social Security Administration (SSA) provides annual COLAs to Social Security and Supplemental Security Income (SSI) benefits. In 2025, the COLA for Social Security benefits is 2.5%, meaning that benefits will increase by this percentage. This adjustment ensures that the purchasing power of these benefits is maintained. Forbes reports on the impact of COLAs on retirees.

- COLAs are typically based on a price index like the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

- Employers may also provide COLAs to employee salaries to help them manage rising costs.

- Minimum wage laws, union agreements, and retiree benefits may include provisions for annual COLAs.

Government Cost of Living Payments and Eligibility

In addition to COLAs for Social Security, governments often provide direct cost of living payments to specific groups. For example, in the UK, the Department for Work and Pensions (DWP) has announced Cost of Living Payments for 2025, offering up to £500 across three installments to eligible individuals. These payments are usually targeted at those receiving benefits such as Universal Credit, Pension Credit, and income-based Jobseeker’s Allowance (JSA). The UK government website offers more information on these payments.

Why Cost of Living Payments Matter

Cost of living payments are vital because they provide a safety net for vulnerable populations during times of economic hardship. They help individuals and families afford essential goods and services, reducing the risk of poverty and financial instability. For instance, the DWP payments in the UK are designed to cover seasonal spikes in household expenses, such as energy costs during winter.

Furthermore, these payments can stimulate the economy by increasing consumer spending. By understanding and accessing these payments, individuals can better manage their finances and maintain a reasonable standard of living. For more detailed information about accessing and managing cost of living payments, check out our comprehensive guide.

Complete Guide to Understanding cost of living payments

Cost of living payments are financial support measures designed to help individuals and families manage rising expenses related to basic needs. These payments are often implemented during periods of high inflation or economic uncertainty to ensure people can afford essential goods and services. Understanding how these payments work, who is eligible, and how to access them is crucial for those facing financial hardship.

Understanding Cost Of Living Payments

Professional guide to cost of living payments – optimized for best results

Eligibility for Cost of Living Payments

Eligibility criteria for cost of living payments vary depending on the specific program and the governing body providing the assistance. Generally, eligibility is tied to receiving certain benefits or meeting specific income thresholds. For example, in the UK, individuals receiving Universal Credit, Pension Credit, income-based Jobseeker’s Allowance (JSA), or income-related Employment and Support Allowance (ESA) may be automatically eligible for cost of living payments. Some programs also target specific vulnerable groups, such as disabled individuals, full-time carers, and households with high energy demands due to medical needs. Always verify your eligibility through official government websites or trusted sources.

- Receiving Universal Credit, Pension Credit, or other qualifying benefits.

- Meeting specific income thresholds set by the program.

- Belonging to a vulnerable group, such as disabled individuals or carers.

Types of Cost of Living Adjustments (COLAs)

Cost of Living Adjustments (COLAs) also refer to increases in Social Security benefits and wages to counteract the effects of inflation. For Social Security, the COLA is calculated annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). In 2025, the Social Security COLA is 2.5%, meaning benefits will increase by this percentage. Employers may also offer COLAs to employees to help them maintain their purchasing power during inflationary periods. These adjustments are not based on performance but rather on the rising costs of basic necessities like housing, food, and energy.

Key Benefits of Cost Of Living Payments

Professional guide to cost of living payments – optimized for best results

How to Access and Secure Cost of Living Payments

Many cost of living payments are distributed automatically to eligible recipients who are already receiving qualifying benefits. However, it’s essential to ensure that your personal and banking information is up to date with the relevant government agencies. Incorrect or outdated records can lead to payment delays or missed payments. Be vigilant about potential scams and only trust official sources for information. The DWP, for example, will never ask for personal details via text or email. For programs that require an application, such as local council support funds, follow the instructions carefully and provide all necessary documentation.

Best Practices and Strategies for cost of living payments

Cost of living payments are designed to alleviate financial pressures on individuals and families, especially during times of economic hardship or rising inflation. To ensure these payments are effective and reach those who need them most, it’s crucial to implement best practices and well-defined strategies.

Ensuring Accurate Eligibility and Payment Delivery

Accurate eligibility verification is paramount. Government agencies must cross-reference data from various sources (e.g., tax records, benefit programs) to confirm recipients meet the established criteria. For example, for the UK’s Cost of Living Payments, eligibility is often tied to receiving benefits like Universal Credit, Pension Credit, or income-based Jobseeker’s Allowance. Payment delivery should be streamlined and secure.

Direct deposit into bank accounts is preferable, reducing the risk of fraud and delays. It’s also important to provide clear communication about payment schedules and amounts, preventing confusion and potential scams. The Social Security Administration’s improved COLA notice, with personalized language and exact dollar amounts, serves as a good example. For troubleshooting common problems with eligibility verification, visit our problem-solving guide.

- Verify eligibility using multiple data sources.

- Prioritize direct deposit for secure and efficient payment delivery.

- Communicate payment details clearly to recipients.

Adjusting Payment Amounts to Reflect Real Needs

A fixed payment amount may not adequately address the diverse needs of recipients. Consider tiered payment structures based on factors like household size, disability status, or location (reflecting varying costs of living). The DWP’s approach of providing additional support to disabled individuals and those with high energy demands is a step in the right direction.

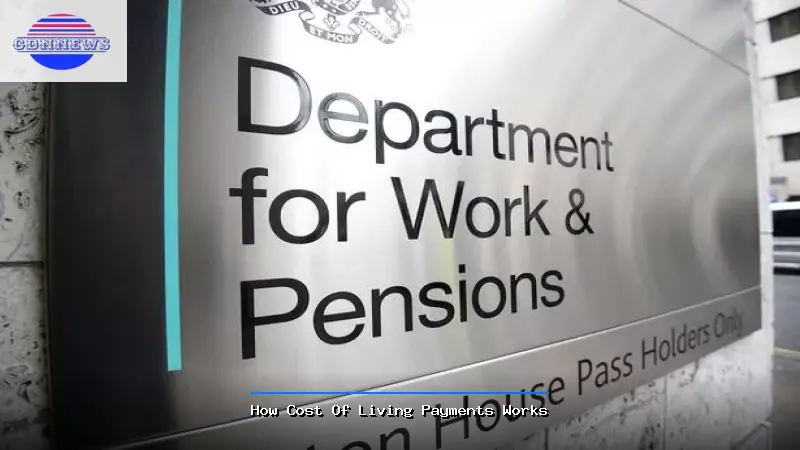

How Cost Of Living Payments Works

Professional guide to cost of living payments – optimized for best results

Regularly review and adjust payment amounts to align with current inflation rates and the Consumer Price Index (CPI). The Social Security Administration’s annual COLA adjustments, based on the CPI-W, demonstrate the importance of keeping payments in line with rising costs. Information about the CPI can be found on the Bureau of Labor Statistics website.

Promoting Awareness and Preventing Fraud

Public awareness campaigns are essential to inform eligible individuals about available cost of living payments and how to access them. Utilize multiple channels (e.g., government websites, social media, community organizations) to reach a broad audience. Emphasize the importance of safeguarding personal information and avoiding scams. Provide clear instructions on how to report suspected fraud. The Social Security Administration’s warnings against phishing schemes and fraudulent calls are a crucial part of protecting beneficiaries. The Federal Trade Commission (FTC) also provides resources on avoiding scams. To learn more about advanced strategies for cost of living payments, see our detailed implementation guide.

Common Challenges and Solutions with cost of living payments

Cost of living payments, while designed to alleviate financial strain, often present various challenges for both recipients and administering bodies. Understanding these challenges and implementing effective solutions is crucial to ensure these payments reach those who need them most and achieve their intended purpose.

Eligibility Verification and Fraud Prevention

One major challenge is accurately verifying eligibility and preventing fraudulent claims. Complex eligibility criteria can make it difficult to determine who qualifies, leading to errors and delays. Scammers may also attempt to exploit the system by submitting false applications or impersonating beneficiaries. For example, the SSA warns against phishing schemes where individuals are asked to provide personal information under false pretenses.

- Implement robust verification processes using data matching with other government agencies.

- Utilize secure online portals for applications and communication to reduce the risk of fraud.

- Educate the public about common scams and how to report suspicious activity.

Payment Delays and Delivery Issues

Another common issue is payment delays, whether due to administrative bottlenecks, outdated recipient information, or banking errors. Recipients with incorrect or outdated banking details on file with the DWP, for instance, may experience delays or missed payments. Paper checks can also be lost or stolen, further complicating the process. Transitioning to electronic payments, as encouraged by the Department of Treasury, can mitigate these risks.

Keeping Pace with Inflation and Varying Needs

Ensuring that cost of living adjustments (COLAs) adequately reflect real-world inflation and the varying needs of different populations is a persistent challenge. While the CPI-W is used to calculate Social Security COLAs, it may not accurately capture the specific expenses faced by all beneficiaries. For example, rising healthcare costs may disproportionately impact older adults. Additionally, a uniform COLA may not be sufficient for individuals in areas with significantly higher living costs. Tailored support, as mentioned in the DWP announcement, can address specific needs. For practical examples, review our case studies collection showing how different regions are addressing this challenge.

Advanced Tips and Future Trends for cost of living payments

Navigating cost of living payments can be complex, but understanding advanced strategies and future trends can help individuals and businesses maximize their benefits and prepare for upcoming changes. This section delves into key tips and forecasts for cost of living payments, ensuring you stay informed and proactive.

Maximizing Social Security COLA Benefits

Understanding how the Social Security Cost-of-Living Adjustment (COLA) works can significantly impact your retirement income. While the annual COLA aims to offset inflation, strategic planning can help you make the most of it. For example, delaying retirement even a year or two can substantially increase your base benefit, leading to a larger COLA increase each year. Also, be sure to review your COLA notice each December in your “my Social Security” account to understand exactly how the adjustment affects your specific benefit amount.

- Monitor CPI-W: Keep an eye on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), as it directly influences COLA calculations.

- Update Information: Ensure your personal and banking information is current with the Social Security Administration to avoid payment delays.

- Beware of Scams: The SSA will never ask for personal details via unsolicited emails or texts.

Future Trends in Employer-Provided COLAs

Advanced Cost Of Living Payments Strategies

Professional guide to cost of living payments – optimized for best results

As inflation persists, more employers may consider offering cost-of-living adjustments to employee salaries to retain talent and maintain morale. Companies might tailor COLAs to specific geographic locations where living costs are higher. We may also see a shift towards more frequent COLA adjustments, potentially semi-annually or quarterly, to better reflect real-time inflation rates. Furthermore, expect increased transparency from employers regarding how COLA increases are calculated and implemented. According to Harvard Business Review, companies are increasingly focusing on employee financial well-being.

The Rise of Targeted Support Programs

Future cost of living support might become more targeted towards specific vulnerable groups. The DWP’s approach of providing additional support to disabled individuals, carers, and households with high energy needs is likely to expand. We can anticipate governments and organizations using more sophisticated data analysis to identify and assist those most affected by rising costs. Additionally, expect a greater emphasis on preventative measures, such as financial literacy programs and job training initiatives, to help individuals build long-term financial resilience. To see a complete list of available resources, visit our tools and resources page.

Comprehensive cost of living payments Data and Comparisons

Here’s a detailed comparison of various cost of living payment approaches, considering their scope, target audience, and adjustment mechanisms.

Best Practices for Cost Of Living Payments

Professional guide to cost of living payments – optimized for best results

| Feature | Social Security COLA (USA) | DWP Cost of Living Payments (UK) | Employer-Provided COLA | Best For |

|---|---|---|---|---|

| Scope | Nationwide benefits for retirees and disabled individuals. | Targeted support for low-income households and benefit recipients. | Specific company employees. | Wide-reaching inflation protection for retirees. |

| Eligibility | Social Security beneficiaries. | Recipients of specific benefits (Universal Credit, Pension Credit, etc.). | Determined by employer policies. | Employees facing rising living costs. |

| Adjustment Mechanism | Based on CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers). | Fixed amounts determined by government, often in installments. | Varies; may be based on CPI or internal company metrics. | Maintaining purchasing power during retirement. |

Important statistics about cost of living payments, highlighting their impact and reach.

| Metric | Value | Source | Year |

|---|---|---|---|

| Average Social Security COLA Increase | 3.2% | Social Security Administration | 2024 |

| Estimated number of UK households receiving DWP Cost of Living Payments | 8 million | Department for Work and Pensions | 2023-2024 |

| Percentage of employers offering COLAs | ~15% | SHRM (Society for Human Resource Management) | 2023 |

A look at the advantages and disadvantages of cost of living payments, along with potential mitigation strategies to address the drawbacks.

| Advantages | Disadvantages | Mitigation |

|---|---|---|

| Provides a financial safety net for vulnerable populations. | Can be insufficient to cover the full extent of rising costs. | Implement tiered payment structures based on need. |

| Stimulates the economy through increased consumer spending. | Risk of fraud and improper distribution. | Strengthen eligibility verification processes. |

| Helps maintain a reasonable standard of living during economic hardship. | May create dependency on government assistance. | Promote financial literacy and job training programs. |

Frequently Asked Questions About cost of living payments

What is cost of living payments?

Cost of living payments are financial assistance programs designed to help individuals and families cope with the increasing expenses of basic necessities like food, housing, and energy. These payments aim to alleviate the burden of inflation and economic pressures, ensuring that people can maintain a reasonable standard of living. They are often targeted at vulnerable populations, such as low-income families, pensioners, and individuals receiving government benefits, providing a crucial safety net during times of economic hardship.

How do I get started with cost of living payments?

To get started with cost of living payments, first determine if you are eligible by checking the specific criteria for programs offered by your government or relevant organizations. Eligibility often depends on receiving certain benefits, meeting income thresholds, or belonging to a vulnerable group.

Visit official government websites or contact your local council to find information about available programs and their requirements. Ensure your personal and banking information is up to date with the relevant agencies to avoid payment delays or missed payments. For best practices on managing your cost of living payments, see our cost of living payments implementation checklist.

What are the main benefits of cost of living payments?

The primary benefit of cost of living payments is providing financial relief to individuals and families struggling with rising expenses, particularly during periods of high inflation or economic uncertainty. These payments help people afford essential goods and services, reducing the risk of poverty and financial instability. They can also stimulate the economy by increasing consumer spending, and contribute to overall well-being and peace of mind by alleviating financial stress.

What are common challenges with cost of living payments?

Common challenges with cost of living payments include accurately verifying eligibility and preventing fraudulent claims, which can lead to errors and delays. Payment delays and delivery issues can occur due to administrative bottlenecks, outdated recipient information, or banking errors. Furthermore, ensuring that payment amounts adequately reflect real-world inflation and the varying needs of different populations can be difficult, as a uniform payment may not be sufficient for everyone.

How much does cost of living payments cost?

Cost of living payments do not cost recipients anything to receive; they are a form of financial assistance provided by governments or organizations. However, for the government administering these programs, the cost can be significant, depending on the number of eligible recipients and the payment amounts. These costs are typically funded through taxes or other revenue sources, and require careful budget planning to ensure the program’s sustainability and effectiveness.

What tools or resources do I need for cost of living payments?

To access cost of living payments, you’ll primarily need access to reliable information sources, such as official government websites or trusted community organizations. You’ll also need to have your personal and financial information readily available, including your Social Security number (or equivalent), bank account details, and proof of eligibility (e.g., benefit statements). A computer or smartphone with internet access can be helpful for completing online applications and staying informed about program updates.

How long does it take to see results with cost of living payments?

The timeline for seeing results with cost of living payments depends on the specific program and its payment schedule. Many programs distribute payments automatically to eligible recipients who are already receiving qualifying benefits, in which case the payment may arrive within a few weeks. For programs that require an application, processing times can vary, but it’s important to stay informed by checking the program’s website or contacting the administering agency for updates. Keep in mind that payment delays can occur due to unforeseen circumstances, such as administrative bottlenecks or technical issues.

What are the best practices for cost of living payments?

Best practices for cost of living payments include ensuring accurate eligibility verification through data matching with other government agencies, prioritizing direct deposit for secure and efficient payment delivery, and communicating payment details clearly to recipients. It’s also crucial to adjust payment amounts to reflect real needs, considering factors like household size, disability status, or location. Public awareness campaigns are essential to inform eligible individuals about available payments and how to access them, while emphasizing the importance of safeguarding personal information and avoiding scams. You can find additional details in our cost of living payments for beginners.

Frequently Asked Questions

Find answers to the most common questions below

How do I get started with cost of living payments?

To get started with cost of living payments, first determine if you are eligible by checking the specific criteria for programs offered by your government or relevant organizations. Eligibility often depends on receiving certain benefits, meeting income thresholds, or belonging to a vulnerable group.

What are the main benefits of cost of living payments?

The primary benefit of cost of living payments is providing financial relief to individuals and families struggling with rising expenses, particularly during periods of high inflation or economic uncertainty. These payments help people afford essential goods and services, reducing the risk of poverty and financial instability. They can also stimulate the economy by increasing consumer spending, and contribute to overall well-being and peace of mind by alleviating financial stress.

What are common challenges with cost of living payments?

Common challenges with cost of living payments include accurately verifying eligibility and preventing fraudulent claims, which can lead to errors and delays. Payment delays and delivery issues can occur due to administrative bottlenecks, outdated recipient information, or banking errors. Furthermore, ensuring that payment amounts adequately reflect real-world inflation and the varying needs of different populations can be difficult, as a uniform payment may not be sufficient for everyone.

How much does cost of living payments cost?

Cost of living payments do not cost recipients anything to receive; they are a form of financial assistance provided by governments or organizations. However, for the government administering these programs, the cost can be significant, depending on the number of eligible recipients and the payment amounts. These costs are typically funded through taxes or other revenue sources, and require careful budget planning to ensure the program's sustainability and effectiveness.

What tools or resources do I need for cost of living payments?

To access cost of living payments, you'll primarily need access to reliable information sources, such as official government websites or trusted community organizations. You'll also need to have your personal and financial information readily available, including your Social Security number (or equivalent), bank account details, and proof of eligibility (e.g., benefit statements). A computer or smartphone with internet access can be helpful for completing online applications and staying informed about program updates.

How long does it take to see results with cost of living payments?

The timeline for seeing results with cost of living payments depends on the specific program and its payment schedule. Many programs distribute payments automatically to eligible recipients who are already receiving qualifying benefits, in which case the payment may arrive within a few weeks. For programs that require an application, processing times can vary, but it's important to stay informed by checking the program's website or contacting the administering agency for updates. Keep in mind that payment delays can occur due to unforeseen circumstances, such as administrative bottlenecks or technical issues.

What are the best practices for cost of living payments?

Best practices for cost of living payments include ensuring accurate eligibility verification through data matching with other government agencies, prioritizing direct deposit for secure and efficient payment delivery, and communicating payment details clearly to recipients. It's also crucial to adjust payment amounts to reflect real needs, considering factors like household size, disability status, or location. Public awareness campaigns are essential to inform eligible individuals about available payments and how to access them, while emphasizing the importance of safeguarding personal information and avoiding scams. You can find additional details in our cost of living payments for beginners.